Gift Tax

What is a gift? The Gift Tax applies to the lifetime transfers of property from a donor to donees. If you are the donor of a gift over the annual exclusion, you are responsible for filing the Gift Tax Return, Form 709, and paying any applicable tax. A gift is the transfer of something of […]

Standard Deduction

What is the standard deduction? The Internal Revenue Code allows taxpayers to take either the standard deduction, a fixed amount that is deducted from adjusted gross income, or itemized deductions when determining their taxable income. The IRS provides an Interactive Tax Assistant to help determine your deduction using their online tool. Deduction amounts by filing […]

Self-Employment Tax

How does it work? Social Security and Medicare taxes are paid to the IRS either as payroll tax or self-employment tax. Your employer withholds payroll taxes from your W-2 wages and remits both the employee and employer match to the IRS. Sole proprietors, in business for themselves, are considered self-employed and are not permitted to […]

Schedule B

Interest and Ordinary Dividends Taxpayers must use Form 1040, Schedule B to report income received in the form of interest and ordinary dividends. Generally, you will report the amounts reported to you on various forms including Forms 1099-INT, 1099-DIV and 1099-OID. Ordinary versus qualified dividends Ordinary dividends are the most common type of dividend, and […]

Schedule A

Itemized Deduction Taxpayers can use the higher of either the standard deduction or the itemized deduction. It’s worth the effort to compare the two methods because it can result in noticeably lower taxable income if you have enough qualifying expenses. Various types of deductible personal expenses can be itemized using Form 1040, Schedule A. Examples […]

The Additional Medicare Tax

The Affordable Care Act added the Additional Medicare Tax effective as of tax year 2013. This is a .9 percent tax on wages and self-employment income above a specific threshold. As of tax year 2021 these thresholds are: Filing Status Income Threshold Married filing jointly $250,000 Married filing separate $125,000 Single $200,000 Head of household […]

Wash Sale

Definition A wash sale has occurred if an investment is sold for a loss and is then replaced with the same or substantially identical investment within 30 days before or after the sale. Losses on a wash sale are disallowed. The loss is instead added to the cost basis of the new investment. See other […]

Bookkeeping for Small Businesses

Bookkeeping Bookkeeping for small businesses involves recording all transactions completed through the course of conducting business activities. If you use cash basis, this includes cash expenses and receipts. Accrual accounting will also include non-cash transactions such as accounts receivable and accounts payable. Properly recording your financial transactions helps you succeed in managing and growing your […]

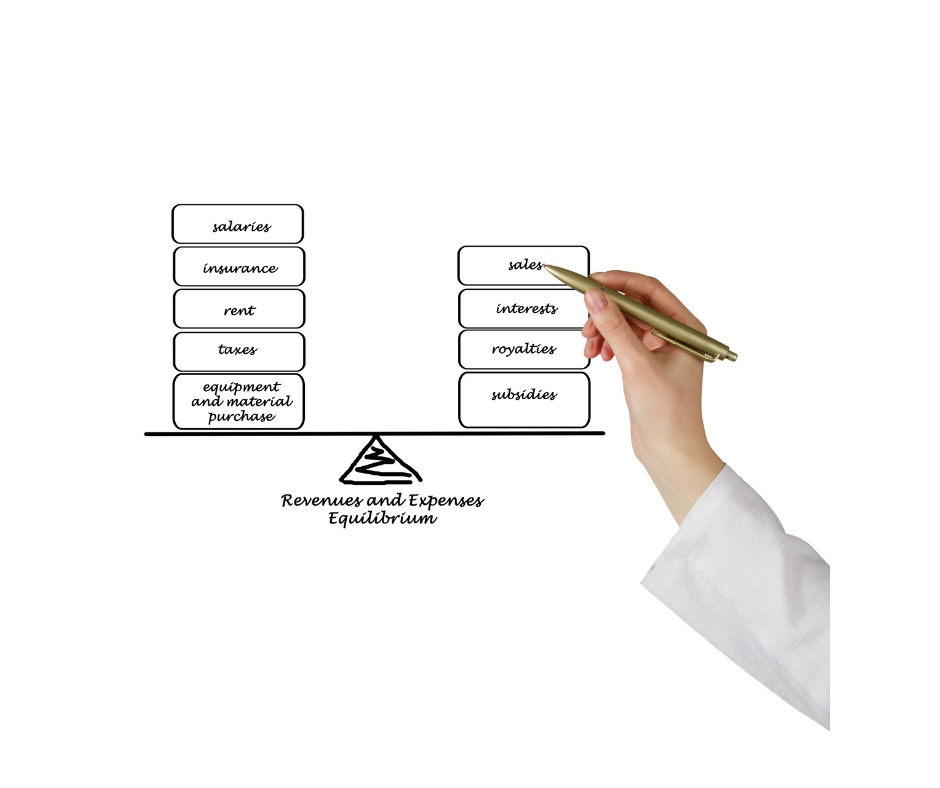

Chart of Accounts

Chart of Accounts The Chart of Accounts is a list of all the accounts a company uses in its accounting system. Five categories of are generally used in the chart of accounts: Assets Liabilities Owner’s Equity Revenues Expenses These categories are then broken down into accounts into which the financial transactions are recorded. Many of […]

Compilation of Financial Statements

A Compilation of Financial Statements is a service engagement, limited in scope, in which an accountant assists company management in the presentation of the financial statements in accordance with the applicable financial reporting framework. Compilations do not include an audit or review. The accountant does not verify the accuracy or completeness of information provided by […]